Are you ready to turn your business dreams into reality? Looking to establish your own Limited Liability Company (LLC) in the United States? You’re in the right place!

My comprehensive LLC registration service includes:

Name availability search

Unique US business address

Registered agent service

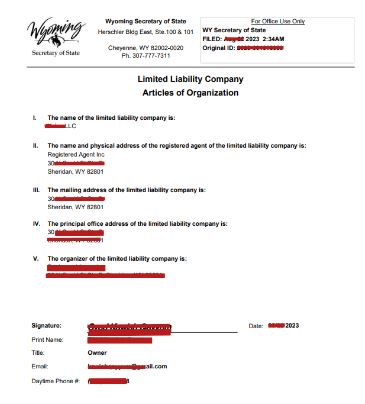

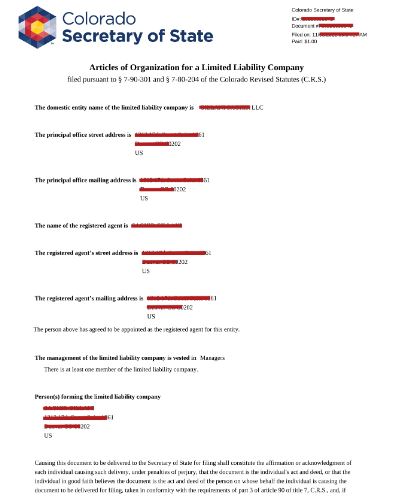

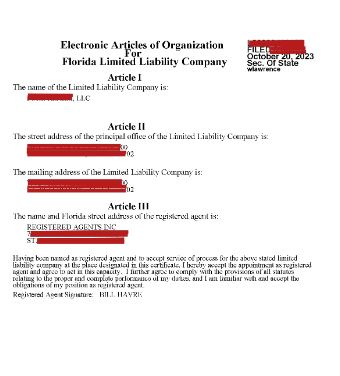

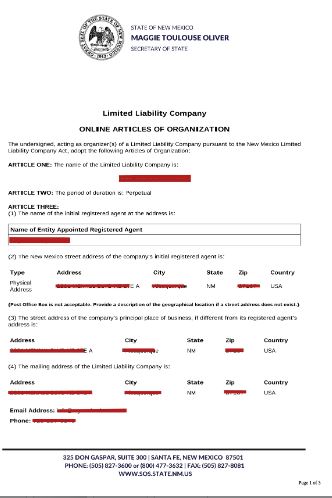

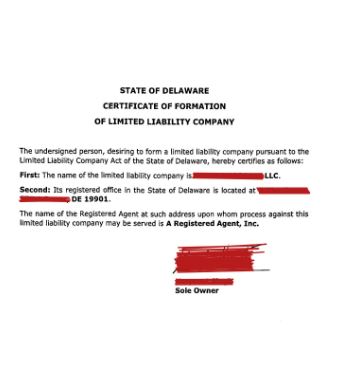

Article of Organization

EIN acquisition with 147c confirmation

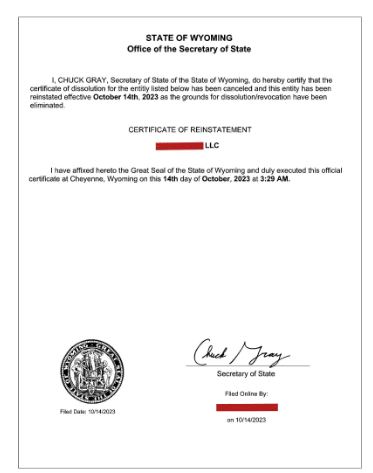

Good Standing Certificate

Let’s make your business dreams a reality. Contact me now to get started!

Can non-US residents register their LLC in the United States?

Yes, non-US residents can register their LLC in the United States.

Do I need a physical US address to form an LLC as a non-resident?

While a physical office address in the US is not always required, you will need a registered agent with a US address to receive legal notices on behalf of your LLC. I can help you set up a registered agent.

What is the cost of state filing fees for forming an LLC?

The state filing fee for forming an LLC varies depending on the state you choose. Contact me to inquire about the specific filing fee for your desired state.

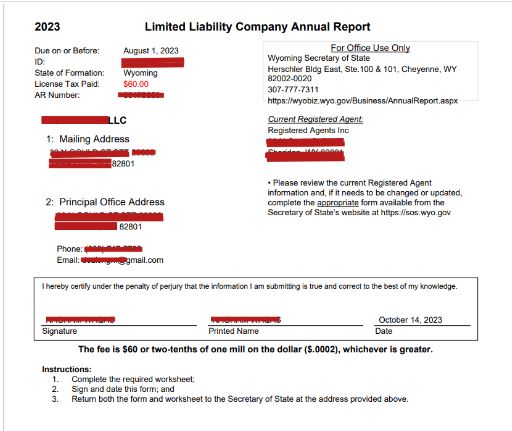

What ongoing compliance requirements are there for an LLC?

LLCs are typically required to file annual reports and pay annual fees. I can help you stay compliant with these obligations.

📌 US LLC Registration & EIN Guidelines for Non-Residents

✅ Step 1: Choose the State for LLC Formation

- Best options for non-US residents:

- Wyoming → Privacy, no state income tax, low annual fees.

- Delaware → Business-friendly laws, popular with investors.

- New Mexico → Cheap formation, no annual reports.

- Pick based on privacy, tax benefits, and costs.

✅ Step 2: Prepare Requirements

- Valid passport (non-US residents don’t need SSN/ITIN for EIN).

- Business name (unique, not already registered).

- Registered Agent (must have a US address in chosen state).

- Mailing/email address for official correspondence.

✅ Step 3: File LLC Formation (Articles of Organization)

- Hire a Registered Agent service.

- Submit the Articles of Organization to the state.

- Pay state filing fee (ranges $50–$300).

- Receive LLC approval (instant – few days depending on state).

✅ Step 4: Apply for EIN (Employer Identification Number)

- Required for:

- Opening US business bank accounts

- Filing US taxes

- Running Amazon FBA, Walmart, Shopify, eBay stores

- As a non-US resident:

- Complete IRS Form SS-4.

- Apply via:

- Fax → EIN issued in ~72 hours.

- Mail → 4–6 weeks.

- Agencies can also get it done within 1–3 business days.

✅ Step 5: BOI (Beneficial Ownership Information) Filing

- New law under FinCEN Corporate Transparency Act (2024).

- Must file within 90 days of LLC approval.

- Report includes:

- LLC name, address, EIN

- Owner details (name, DOB, address, ID/passport copy)

- Filing is free & online at FinCEN’s website.

✅ Step 6: Open a US Business Bank Account

- Options for non-residents:

- Online banks → Mercury, Wise, Payoneer, Relay.

- Traditional US banks → may require physical visit.

⚡ Key Benefits of US LLC for Non-Residents

- Access to Amazon FBA, Walmart, Shopify, eBay marketplaces.

- Legal US business entity with global credibility.

- Tax advantages (depending on structure).

- Ability to open US bank accounts & payment gateways.

⏳ Timeline Overview

- LLC Formation → 1–3 business days (state dependent)

- EIN → 72 hours (fax) or 1–3 days with agency

- BOI → Same day online

📌 Summary for Clients:

“Even if you are not a US citizen or resident, you can register a US LLC, get an EIN in 72 hours, file BOI online, and start doing business legally in the US.”

📘 Guidelines: US LLC Registration & EIN for Non-US Residents

🔹 Step 1: Choose the Right State

- Wyoming → Low annual fees, privacy, tax-friendly.

- Delaware → Investor-friendly, strong legal framework.

- New Mexico → Low-cost, no annual reports.

👉 Select based on cost, privacy, and business goals.

🔹 Step 2: Prepare Basic Requirements

- Valid passport / government-issued ID.

- Unique business name.

- Registered Agent with a US address (mandatory).

- Email and mailing address for documents.

🔹 Step 3: File the LLC (Company Formation)

- Hire a Registered Agent service.

- Submit Articles of Organization to the Secretary of State.

- Pay the state filing fee ($50–$300 depending on state).

- Get LLC Certificate of Formation/Approval.

🔹 Step 4: Apply for EIN (Employer Identification Number)

- Needed for:

- US bank accounts

- Amazon FBA, eBay, Walmart, Shopify accounts

- Filing taxes

- Process:

- Fill IRS Form SS-4.

- Apply via fax (72 hours), mail (4–6 weeks), or use a service provider.

- No SSN/ITIN required for non-residents.

🔹 Step 5: BOI (Beneficial Ownership Information) Report

- Mandatory from 2024 (FinCEN Corporate Transparency Act).

- File within 90 days of LLC approval.

- Report details:

- LLC info (name, address, EIN)

- Owner info (passport, DOB, ID, address)

- Filing is free & online on the FinCEN website.

🔹 Step 6: Open a US Business Bank Account

- Online banks for non-residents:

- Mercury, Wise, Payoneer, Relay

- Traditional banks may require a US visit.

⚡ Benefits of a US LLC for Non-Residents

- Build global business credibility.

- Access to Amazon FBA, Walmart, Shopify, eBay.

- Open US bank & payment gateways.

- Tax optimization opportunities.

- Simple compliance requirements.

⏳ Timeline Overview

- LLC Formation → 1–3 business days (varies by state)

- EIN Issuance → 72 hours via fax / 1–3 days (agency)

- BOI Filing → Same day online

📌 Final Note for Clients:

Even as a non-US resident, you can easily form a US LLC, obtain an EIN within 72 hours, complete BOI filing, and legally start your business in the US market.

+ There are no comments

Add yours